Unlocking the Power of NFTs with an Easy-to-Use API Solution

In recent years, there has been a significant surge in the popularity and adoption of

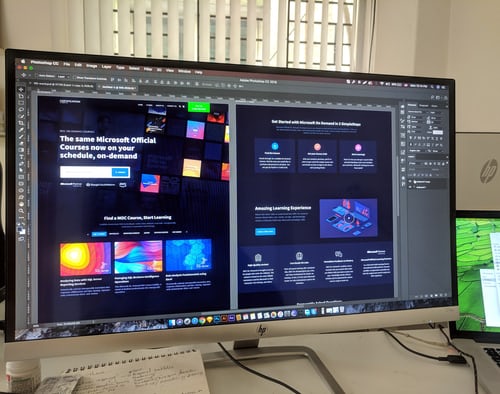

“A good website is always under construction”!

Every day thousands of people try their luck! Why not you?

It is a long established fact reader Lorem Ipsum is dummy will page when looking be distract.

It is a long established fact reader Lorem Ipsum is dummy will page when looking be distract.

It is a long established fact reader Lorem Ipsum is dummy will page when looking be distract.

In recent years, there has been a significant surge in the popularity and adoption of

For any business in today’s digital landscape, having a robust and efficient website is crucial.

Today, the majority of web professions, specifically the most promising ones, are generally carried out

Before creating a website, it is important to know everything you need to know to

For the smooth running of activities within a company, the intervention of a manager is

Web design is one of the most important steps in the creation of a website.

The biggest objective of companies, whether commercial or not, is to have more visibility on